Nature

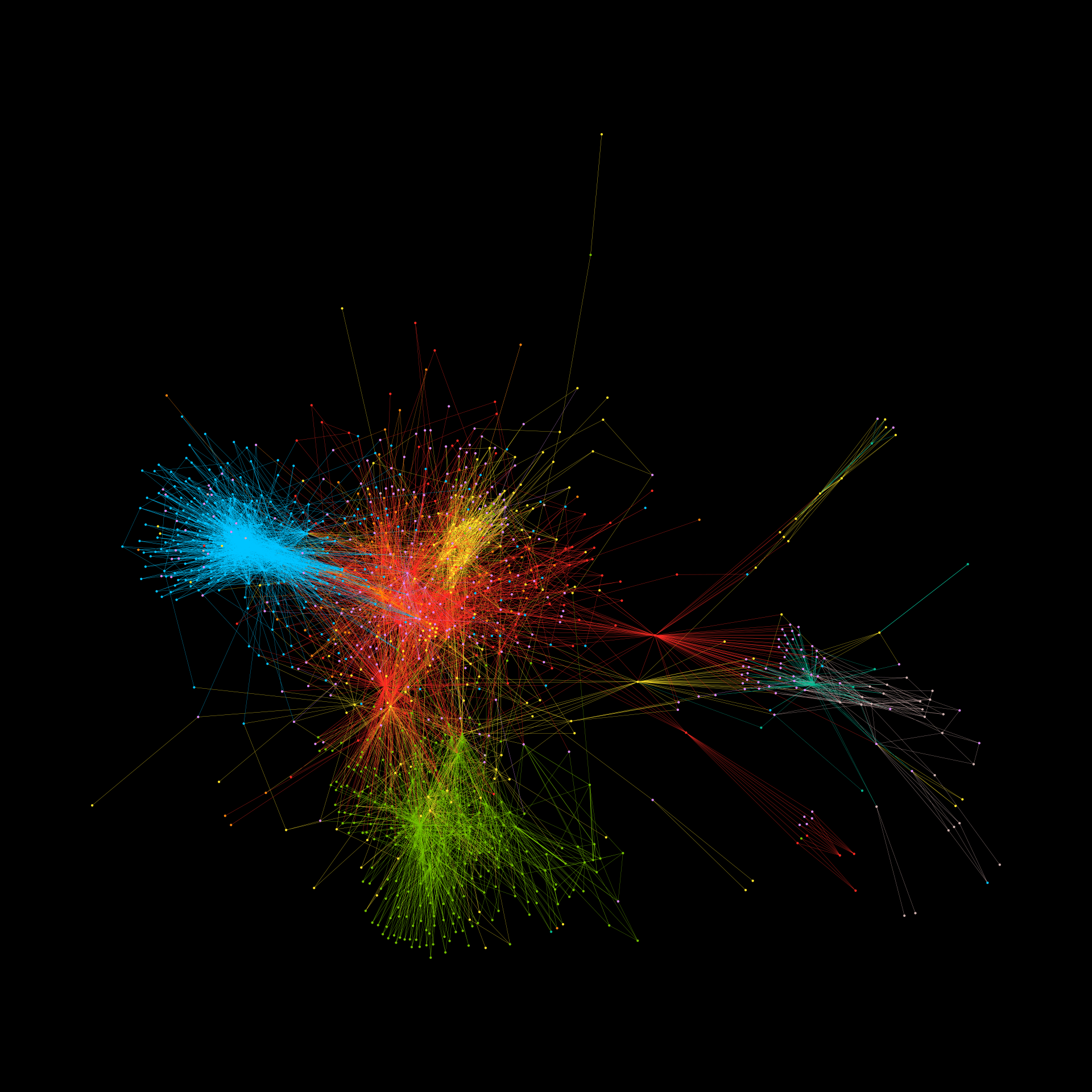

Online hate and extremist narratives have been linked to abhorrent real-world events, including a current surge in hate crimes and an alarming increase in youth suicides that result from social media vitriol; inciting mass shootings such as the 2019 attack in Christchurch, stabbings and bombings; recruitment of extremists, including entrapment and sex-trafficking of girls as fighter brides; threats against public figures, including the 2019 verbal attack against an anti-Brexit politician, and hybrid (racist–anti-women–anti-immigrant) hate threats against a US member of the British royal family; and renewed anti-western hate in the 2019 post-ISIS landscape associated with support for Osama Bin Laden’s son and Al Qaeda. Social media platforms seem to be losing the battle against online hate and urgently need new insights. Here we show that the key to understanding the resilience of online hate lies in its global network-of-network dynamics. Interconnected hate clusters form global ‘hate highways’ that—assisted by collective online adaptations—cross social media platforms, sometimes using ‘back doors’ even after being banned, as well as jumping between countries, continents and languages. Our mathematical model predicts that policing within a single platform (such as Facebook) can make matters worse, and will eventually generate global ‘dark pools’ in which online hate will flourish. We observe the current hate network rapidly rewiring and self-repairing at the micro level when attacked, in a way that mimics the formation of covalent bonds in chemistry. This understanding enables us to propose a policy matrix that can help to defeat online hate, classified by the preferred (or legally allowed) granularity of the intervention and top-down versus bottom-up nature. We provide quantitative assessments for the effects of each intervention. This policy matrix also offers a tool for tackling a broader class of illicit online behaviours such as financial fraud.

N. F. Johnson, R. Leahy, N. Johnson Restrepo, N. Velasquez, M. Zheng, P. Manrique, P. Devkota, S. Wuchty